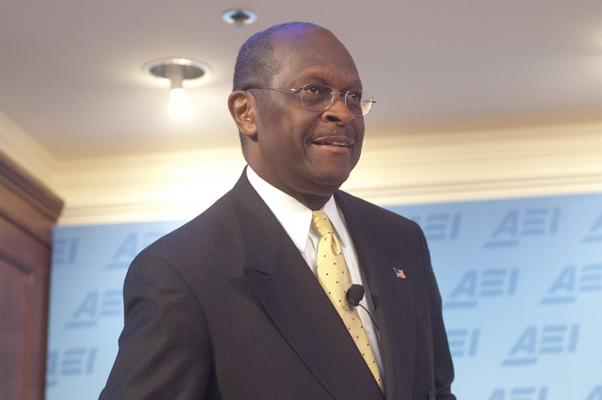

| Herman Cain Discusses 9-9-9 at AEI ...1 of 4 > |

|

| Oct. 31, 2011--In an event

at the American Enterprise Institute, Herman Cain discussed his 9-9-9

plan, which would replace the current tax code with a 9-percent

personal income tax, a 9-percent national sale tax and a 9-percent

corporate tax. AEI's Kevin

Hassett moderated the discussion, starting on Cain's experience at

Godfather's Pizza and how that contribute to 9-9-9. Cain said he

"became

much more aware of potential negative impact of government" when he was

chairman of Godfather's. He had made necessary changes to the

business, simplifying and introducing a new value product,

and then found he had to contend with external factors including a

raise in the

minimum wage, labeling laws, and paid leave. The

discussion turned to Cain's relationship with conservative icon Jack

Kemp, and Cain agreed that

"there are Kemp's fingerprints are all over 9-9-9." Cain noted he "had been working on tax reform and tax replacement for decades." He stated, "I was a supporter of the flat tax on income when I thought it had a chance of passage when Dick Armey was talking about it, Steve Forbes ran for president on it; anything to replace the current tax code, I was for." Cain said the national consumption tax and flat tax on income "both offered some very positive benefits." He then explained how 9-9-9 came about: "One of the objectives was let's get both of these groups to the table. So therefore the 9-percent flat tax on personal income brought the flat tax people to the table. The 9-percent on retail sales brought the FairTax people to the table. And so we have now a built in support for the concept. Now the FairTax people were a little upset at me at first because it wasn't all FairTax, but the decision we made strategically was let's get America used to the fact that a national retail sales tax is a good thing, and it's a lot easier to sell a 9-percent rate than a 23 percent." And he set out basic principles behind the plan: "We wanted it to be simple, which it is. We wanted it to be transparent, which it is. Nine-nine-nine. There are no other nines; we don't have any hidden nines. We want it to be efficient. We spend collectively $430 billion a year filing and complying. That money doesn't have to would seek to have to be spent. And we wanted it to be fair—fair according to Webster's Dictionary, not Washington, which is everybody gets treated the same. What a novel idea." Cain further said that when he takes office he would seek to have 9-9-9 passed retroactive to Jan. 1, 2013 as that would provide a significant boost to the economy. AEI video |

|

|

|

|

|

| next |